Offshoring business services has become a dominant strategy for companies worldwide, aiming to cut costs, expand talent pools, and improve overall efficiency by tapping into the global workforce. The market has seen exponential growth, soaring from $624 billion in 2022 to a staggering $681 billion in 2023, with projections suggesting an annual growth rate of 8 percent through 2027.

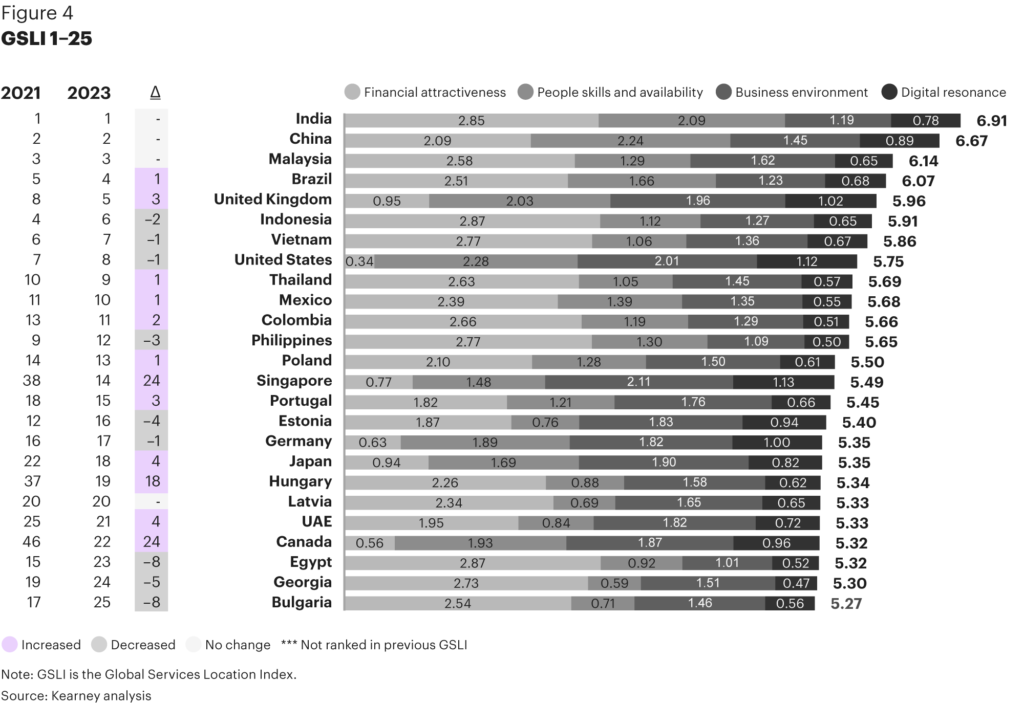

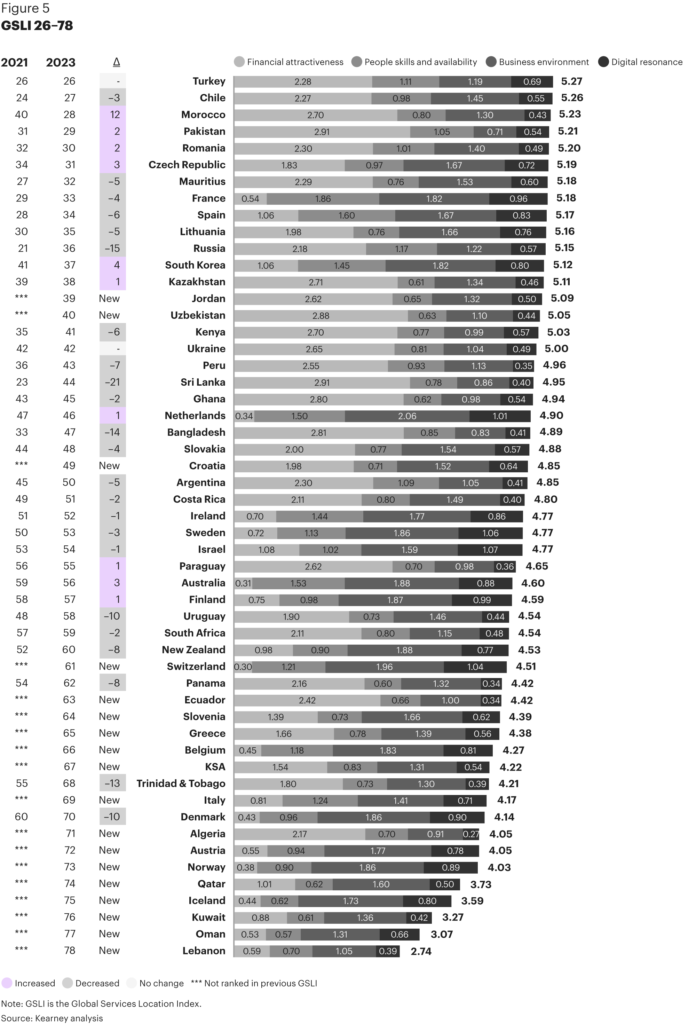

Decisions regarding offshore locations are influenced by various factors such as labor costs, skill availability, infrastructure, business environment, and associated risks. Kearney’s Global Services Location Index (GSLI) serves as a valuable tool for evaluating these aspects and identifying potential offshoring destinations.

This year, the GSLI brings attention to the critical importance of talent regeneration. It emphasizes how swiftly countries need to adapt and reskill their workforce amidst evolving market landscapes and technological advancements. Key factors impacting a nation’s ability to replenish its talent pool include education systems, labor conditions, immigration policies, governmental support, and digital infrastructure – all of which significantly contribute to a competitive advantage.

India, China, and Malaysia maintain their top positions owing to their cost-effectiveness, abundance of talent, and robust skill sets. Notably, India and China exhibit strengths in talent regeneration, particularly in the availability of tech-enabled workforces.

While Asia Pacific nations continue to dominate, the GSLI rankings have seen shifts – the Philippines dropped out of the top 10 while Mexico ascended to the 10th place. A significant milestone is the United Kingdom’s rise to fifth place, marking the first time a western economy has entered the top five in the GSLI rankings.

Talent regeneration is now a critical necessity globally, considering the significant disruptions experienced in the talent supply chain. Influential factors such as Industry 4.0 technologies, geopolitical shifts, conflicts, demographic changes, and economic fluctuations have reshaped workforce demands. This has led nations and organizations to reevaluate their talent sourcing and management strategies.

Effectively regenerating the talent supply chain requires strategic actions across four essential dimensions:

- Identifying Skills Requirements: Forecasting macro trends and socioeconomic conditions to predict and address skills gaps.

- Closing the Skills Gap through Training: Investing in reskilling and upskilling programs while improving the overall employee experience to retain talent.

- Sourcing the Workforce: Leveraging trends like nearshoring, digital nomad hiring, and tapping into retired talent pools to diversify and acquire skilled workers.

- Creating New Delivery Models: Implementing favorable policies that facilitate work center establishment, outsourcing, and encouraging both domestic and international enterprise involvement.

Countries must create environments that attract companies and talented individuals by emphasizing training opportunities and employment prospects. Continuous identification of crucial skills, fostering sustainable partnerships, and encouraging ongoing investment in training by larger enterprises are essential due to the cyclical nature of talent supply chain regeneration.

Immediate economic advantages arise from meeting immediate skills requirements. However, nurturing an ecosystem for continuous talent regeneration promises lasting benefits for countries in the long run.

Reference :

Regenerative talent pools – Kearney. (2023). Kearney. https://www.kearney.com/service/digital/gsli/2023-full-report